Latest News: ATM Cash Withdrawal Tax Pakistan 2025: New Rate and Limit Announced

ATM Cash Withdrawal Tax Pakistan

In 2025, the Government of Pakistan has made a major change to how people withdraw cash from banks. Under the new ATM Cash Withdrawal Tax Pakistan 2025, those who are non-filers (people not registered for tax) will now have to pay a withholding tax on large daily withdrawals, while filers (registered taxpayers) remain fully exempt. This move aims to increase transparency, reduce undocumented cash circulation, and encourage more people to become tax filers. Let’s break down what’s new, why it matters, and how it will affect both filers and non-filers across the country.

Quick Details

| Category | Details |

| Program Name | ATM Cash Withdrawal Tax Pakistan 2025 |

| Implemented By | Federal Board of Revenue (FBR) |

| New Tax Rate | 0.8% (for Non-Filers) |

| Daily Limit | Rs. 75,000 per day |

| Filers’ Status | Fully Exempt |

What Changed in ATM Cash Withdrawal Tax Pakistan 2025?

The government has revised the withholding tax policy under the 2025 Finance Act. Previously, non-filers paid 0.6%, but now the rate has increased to 0.8%. At the same time, the daily withdrawal threshold has been raised from Rs. 50,000 to Rs. 75,000.

This means if a non-filer withdraws more than Rs. 75,000 in one day, tax will be charged on the amount exceeding that limit. Meanwhile, taxpayers listed in the Active Taxpayers List (ATL) remain exempt from this tax.

Why Did the Government Make These Changes?

The government wants to increase the number of registered taxpayers and promote a transparent financial system. A large portion of Pakistan’s economy still operates in cash, making it difficult to track transactions and ensure tax compliance. Through ATM Cash Withdrawal Tax Pakistan 2025, the goal is to reduce untaxed cash usage and motivate citizens to become active tax filers. The change also aligns with international commitments, including recommendations from the IMF, to improve Pakistan’s revenue performance and tax-to-GDP ratio.

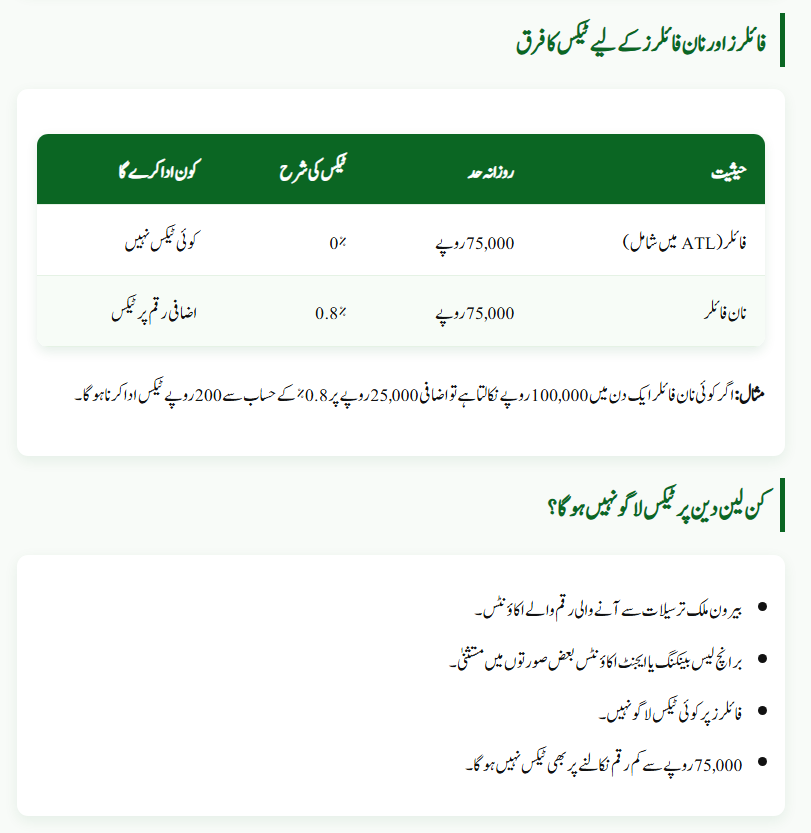

How Is the Tax Applied? Filers vs Non-Filers

| Status | Daily Limit | Tax Rate | Who Pays |

| Filer (in ATL) | Rs. 75,000 | 0% | No tax applied |

| Non-Filer | Rs. 75,000 | 0.8% | Tax on amount above the limit |

Example:

If a non-filer withdraws Rs. 100,000 in a day, only Rs. 25,000 (amount above Rs. 75,000) will be taxed at 0.8%.

That means Rs. 200 will be deducted as withholding tax.

If you are a filer, no tax applies at all — no matter how much you withdraw.

Which Withdrawals Are Exempt from This Tax?

- Accounts funded only by foreign remittances (with proof).

- Some branchless banking or agent-based accounts under special rules.

- All withdrawals made by filers.

- Withdrawals below Rs. 75,000 per day, even for non-filers.

How Is This Different from Bank or ATM Fees?

It’s important to understand that this is a government tax, not a bank service charge. Banks may still charge their own ATM or inter-bank withdrawal fees — but those are separate from the ATM Cash Withdrawal Tax Pakistan 2025. In short, this tax is collected by the FBR, while regular ATM service fees go to your bank.

Impact of ATM Cash Withdrawal Tax Pakistan 2025

For Non-Filers:

- Additional cost on large cash withdrawals.

- Increased tracking and transparency of financial activity.

- Strong motivation to register as tax filers.

For Filers:

- No tax deduction on cash withdrawals.

- Smooth banking and financial transactions.

- Incentive for continued tax compliance.

For the Economy:

- Higher government revenue collection.

- Reduced cash-based (informal) transactions.

- Improved transparency in the financial system.

- Better documentation of economic activity.

Government Response and Monitoring

The Federal Board of Revenue (FBR) is now implementing a tighter digital monitoring system. All daily cash withdrawals — whether through ATMs or over-the-counter — will be automatically tracked. If public cooperation improves, authorities may consider future relief or tax adjustments. This initiative aims to bring more people into the formal economy while ensuring fair tax practices.

Read Also: CM Punjab Solar Tubewell Scheme 2025Filers vs Non-Filers — Comparison Table

| Category | Filers | Non-Filers |

| Tax Applied | No | Yes (0.8%) |

| Daily Limit | Rs. 75,000 | Rs. 75,000 |

| Ease of Banking | High | Lower |

| Extra Cost | None | Yes |

| Benefit | Legal protection, smooth banking | Tax deduction on withdrawals |

Frequently Asked Questions (FAQs)

- What is the ATM cash withdrawal tax rate for 2025?

The tax rate is 0.8% for non-filers on amounts withdrawn above Rs. 75,000 per day. Filers are exempt. - Are all daily withdrawals counted together?

Yes. ATM and branch withdrawals made in one day are combined before applying the Rs. 75,000 limit. - Has the limit always been Rs. 75,000?

No. Previously, it was Rs. 50,000. The government increased it to Rs. 75,000 in the 2025 revisions. - Is this the same as the ATM service fee?

No. The ATM service or inter-bank withdrawal fee is charged by your bank, while this is a government tax. - How can non-filers avoid this tax?

Simply register as a tax filer. Once your name is on the Active Taxpayers List (ATL), this tax will no longer apply to your withdrawals. - Read Also: CM Punjab E-Taxi Scheme Registration Closed

Conclusion

The ATM Cash Withdrawal Tax Pakistan 2025 is a major step toward financial transparency and tax compliance. By increasing the tax rate to 0.8% and the daily limit to Rs. 75,000, the government aims to bring more citizens into the formal economy. While non-filers may find this policy burdensome, it ultimately benefits the national economy by ensuring accountability and stability. Becoming a filer not only saves you money but also helps Pakistan build a stronger, more transparent financial system for the future.